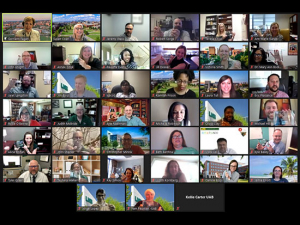

COVID-19 has devastated finances at the global and personal level while forcing older people worldwide to confront the very real threat of imminent death. If there is one key takeaway for older Americans and caregivers of older Americans, according to researchers and financial experts on a May 13 webinar led by the Consumer Financial Protection Bureau, it is this: act now.

COVID-19 has devastated finances at the global and personal level while forcing older people worldwide to confront the very real threat of imminent death. If there is one key takeaway for older Americans and caregivers of older Americans, according to researchers and financial experts on a May 13 webinar led by the Consumer Financial Protection Bureau, it is this: act now.

The researchers and experts explained national trends in aging and gave an overview of the financial conversations that older Americans and their families need to have about the costs of caregiving.

‘Have these conversations early’

"I hope what you gathered is the sense of importance of having these conversations early — conversations about quality of care and financial health," said Mary Hamman, Ph.D., who studies health economics at the University of Wisconsin and is associate director of the Retirement and Disability Research Center at the university's Center for Financial Security.

Older Americans who are considering asking a loved one or friend to become a financial caregiver should ask themselves several questions, said Lisa Schifferle, senior policy analyst for the Consumer Financial Protection Bureau's Office for Older Americans:

- Do I trust this person?

- Do I feel comfortable sharing my wishes with them?

- Are they willing and able to take on the responsibility?

- Is this someone who can manage money and property in my best interest and keep good records?

These questions, other points to consider and much more information is available in the Consumer Financial Protection Bureau’s new guide, Considering a financial caregiver? Know your options. Money is always a delicate subject, Hamman said, but the reality that many families face is that care for aging family members can be extremely difficult, both emotionally and financially.

The bureau produces several Managing someone else's money publications, which can guide prospective caregivers through the legal and other considerations involved in acting as:

There are multiple types of informal and formal caregiving roles, Schifferle said.

Informal financial caregivers may be

- Conversation partners, who may receive copies of a person’s bank statements or accompany them to appointments with their financial adviser;

- Trusted contact persons, who are designated to be informed if a financial institution suspects a person is being exploited; or

- Listed on a convenience account, which allows the caregiver to deposit or withdraw money for someone else but does not give the helper the right to keep the money when the person dies (as opposed to a joint account, which does let the joint account holder keep the money when the person dies).

Formal financial caregivers may be designated as

Each of these roles is explained in downloadable, no-cost publications on the bureau's website, consumerfinance.gov.

What the research says

The most difficult part of preparing for caregiving is that these situations often arise suddenly. The COVID-19 pandemic has been a forceful reminder that "caregiving arrangements are fragile and health is fragile," said speaker Yulya Truskinovsky, Ph.D., assistant professor at Wayne State University. Truskinovsky studies long-term care and aging and recently helped lead a large study of the financial impacts of COVID-19 on older Americans.

Some 53 million Americans provide regular care to a loved one, Truskinovsky said, including one in three grandparents who regularly care for their grandchildren. "Family caregiving has become increasingly complex," she said, with about six in 10 family caregivers to the elderly regularly performing medical or nursing tasks.

Caregivers bear significant financial burdens

"Caregivers are also breadwinners," Truskinovsky added. Over half of family caregivers also work. Caregiving can have a dramatic effect on a person's employment and overall financial circumstances, Truskinovsky said. Nearly three-quarters of caregivers are employed in the year before they start caregiving. But the likelihood of working falls by 3-5% in the two years after caregiving starts. "And many caregivers never return to the labor market." Many future caregivers even reduce their employment before caregiving starts, Truskinovsky added. They anticipate future responsibilities and are more likely to turn down promotions or job opportunities that may involve travel or relocation.

Even in the best of times, there are few decisions so gut-wrenching and finance-destroying as those surrounding care for aging family members. Hamman studies patterns in the living arrangements of older adults. She has found that the proportion of older Americans living by themselves or with family has increased dramatically. In 1980, 40% of Americans age 90 or older lived in nursing homes. By 2018, that number was about 20%. But the trend is driven almost entirely by Americans of lower incomes, particularly in the wake of the Great Recession of the 2000s.

Oddly, Americans with lower incomes are more likely to be in assisted living than they were four decades ago, Hamman has found. How, exactly? According to 2020 data, the average annual cost of assisted living facilities was $51,600, she explained — or some five times the average annual cost of day care for children. "These are big financial burdens for families," Hamman said. This is why families who might not have had any experience with Medicaid or other low-income support programs previously commonly find themselves becoming Medicaid-eligible after older relatives enter nursing home care. "They exhaust their resources quickly," Hamman said. So how are they able to afford assisted living at all?

How are lower-income Americans able to pay for assisted living?

One answer lies in two programs — Medicaid and the Supplemental Security Income Program. Both have income and asset limits, Hamman said, but they have different requirements for documenting health or disability needs, and the requirements also vary widely by state. All states offer support for care for those who qualify in a nursing home setting. In some states, but not all, there is support for care in assisted living facilities.

Many older adults rely on Medicaid to pay for nursing home care and, in most states, community-based care such as assisted living.

The Supplemental Security Income Program, in some states, offers supplemental payments to help older adults pay for room and board or other necessary daily living expenses, Hamman said.

"Supplemental Security Income benefits are reduced in situations where an older adult moves in with, for example a family member, like an adult child — unless the older adult is contributing to room and board expenses,” Hamman said. “So some of those financial discussions that you have about caregiving and planning really will need to get into the very detailed discussions of who will pay for what."